A Short History of LeftoverSwap

Little did I know how this email would dictate my life for the next several months. I folded up my sheets, set them in my designated corner, and headed back to what was now the office couch, formerly bed.

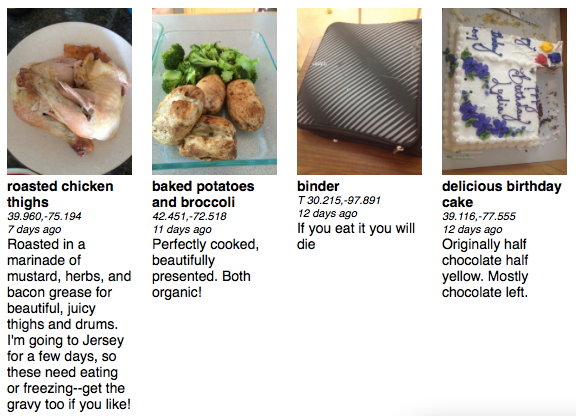

A snapshot of some leftover food posts.

The past

Three years back, I had traveled to Seattle to visit my old college roommate to feast, dream, and rest in the salty humidor of a coastal city. Our relationship was built much more on conversations about ideas, philosophies, and music rather than alcohol, video games, sports, or women in our life, and in 2010 the conversation gravitated toward Silicon Valley’s absurdity. Like Facebook recruiting videos describing how the video chatting application would, like, change the way the world communicated. And like the outrageous bags of money going to adding social layers to everything, connecting people who like potatoes with other people who like potatoes: potatr or some other bullshit like that. Sure, we were a bit jealous that our parking space social network didn’t take off, but at least we were still grounded. And no matter, we had our own parking spaces.

We discussed what other concepts that could benefit from some slapped-on digitized social features. And while we did, we found ourselves with a modern quandary: too much pizza, and too little fridge space.

“I wish we could share that we had extra pizza available.”

And so LeftoverSwap was born. A hasty watermelon logo chosen. A quick website set up with limited functionality. But it was getting late. And a day or so later, I headed off back to other places for awhile. The site languished, development stalled, and leftovers trashed. For three years.

The nearer past

Earlier last year, I relearned some web development. I took the LeftoverSwap idea as some good sample content, created some nice graphics, grabbed some stock photos, faked some screenshots, and came up with something seemingly halfway legitimate. Legitimate enough that the San Francisco reporter and then thousands of others at least believed in it, if only for the time required to have an initial revulsion.

After she published the small blurb in the SF Weekly, it echoed through NPR, BBC, newspapers, and hundreds of radio shows. I answered reporters’ questions and spouted off a litany of food waste and hunger facts while I sat, or paced, in my boxer-briefs. My sister texted saying that she heard Paula Poundstone joke about it on “Wait Wait…Don’t Tell Me!” I grew up with Poundstone’s rasp voicing the characters of some cartoon favorites, and to have her acknowledge and riff on something my brain thought about is LeftoverSwap’s greatest accomplishment.

Of course, we didn’t whip the press up with just a website. Soon after that first article, my old roommate took to his computer like he did back in his nocturnal computer science class days. I filled him in on the latest mentions, hoping each one would somehow polish and speed up the release of the final, real, app. It took him a few months, and it lacked many features (no potato networking), but it was published. In the app store.

Would people use it? Would this actually work?

The nearest past

We launched, I sent out an announcement to our email list, and we waited. We got word of the first swap: Pop Chips in New York City. To have people actually download it was astonishing. To have the system actually work? Well, a cherry on top.

Overall, we have had about 10,000 downloads, and 90% of those actually created an account. We now have a stockpile of thousands of leftover food photos. As to what we’ll do with them, who knows – maybe one of those giant pictures made up of thousands of thumbnails. A giant half-eaten pizza, made out of thousands of half-eaten pizza photos.

Website traffic over three months after the launch.

The fervor of the launch has died down, but posts still accumulate. We’ve both had other projects and circumstances carry us away from this experiment. I’m open to suggestions on where to carry it next, though — we have yet to put out an Android app, though we have some fundamental code written (or so I hear). A web-based version would also be awesome. Perhaps open-sourcing and letting the community take control is the next step.

Learnings, if any

LeftoverSwap is on the edge of acceptable – technology-wise and socially. It’s on this possibility frontier that things happen and move society in one direction or another. When first conceived, the lack of GPS-enabled phones didn’t support the idea. When first conceived, the thought of meeting strangers through the Internet still carried a lot of stigma (ew, who uses the Internet? What kind of creeps? Oh wait, I guess I use the Internet. Maybe OKCupid isn’t that bad. Maybe Tinder is on to something…).

On this frontier is where people have intense reactions, as well. These are the kind of reactions that the press loves to induce in their audience, and will heavily report on: “And did you hear about this? Did you hear about this one? How would you like to EAT someone ELSE’S leftovers!?! Story at 10.” And the press is how you get the word out about anything — especially when you don’t have a cent to spend.

A few other random lessons:

- Reporters are extremely nice – especially the Japanese who gave me a pizza and a mousepad of Mt. Fuji.

- You never know where posting ideas on the Internet can lead.

- Making an app is hard, and will take you at least twice as long as you expect.

- If there seem to be laws against what you’re doing, do it anyway, just to see if anything happens. This does not include murder or any of the bad ones.

- All those “Featured in x publication, x website, and x show” that companies tend to list are meaningless.

And that’s a short history of LeftoverSwap.